Cost of living tops Detroiters’ priorities for US government

Contact: Lauren Slagter, lslag@umich.edu

With Michigan poised to be a pivotal state in the 2024 presidential election, Detroiters have weighed in on their priorities for the U.S. government.

Cost of living and inflation is the issue Detroiters mentioned most when asked about the top issues they want the U.S. government to address, according to a new report from the University of Michigan’s Detroit Metro Area Communities Study, with support from Poverty Solutions.

DMACS partnered with Outlier Media to survey 1,100 Detroit residents in April about their intentions to vote and priorities for the government in 2024. Information about Detroiters’ priorities was collected via open-ended questions, so residents responded in their own words without the limitations of a set of response options. Survey results were weighted to reflect the city’s population as a whole.

The survey found that 20% of Detroit households cited cost of living and inflation as one of the top two priorities for federal government officials, and survey respondents called for federal action to: “bring prices back down,” “regulate the price of food, gas, utilities,” and “lower prices on groceries and gas.”

Crime and safety was the next most frequently mentioned broad issue that Detroiters want U.S. federal officials to address, with 14.8% citing it as one of their top two priorities. Health care came in third, with 14.5% of Detroiters indicating that health care access or quality should be a top priority for the U.S. government. People mentioned the need for “universal health care,” “great health care for all without red tape,” and “(better support and services for) mental health.”

Mara Ostfeld

“Detroit is the largest city in Michigan and will have significant influence over the state’s election outcomes for the presidential race as well as filling the U.S. Senate seat previously held by Debbie Stabenow,” said Mara Ostfeld, a faculty lead for DMACS. “It’s crucial to understand what Detroiters are looking for from the federal government right now.”

The survey found large gaps in the importance assigned to different issues across ethnoracial groups. Cost of living and inflation is the most frequently mentioned issue for the U.S. government to address among Black (20%) and Latino Detroiters (26%), compared to 11% of white Detroiters. For white Detroiters, health care is the most frequently mentioned issue (24%); health care was also a top priority for 23% of Latino residents, compared to 12% of Black residents.

Donna Givens Davidson

“Detroiters want neighborhood sustainability, economic development and a say in their communities. The federal government has an obligation to be responsive to the clear priorities laid out by Detroit residents,” said Donna Givens Davidson, president and CEO of the Eastside Community Network, which develops people, places and plans for sustainable growth on Detroit’s east side.

Looking at priorities for the U.S. government by Detroiters’ income level, cost of living and inflation remained a top priority across income groups.

“It may be counterintuitive, but Detroiters with higher household incomes were no less likely to mention cost of living and inflation as a top priority for U.S. elected officials than Detroiters with lower household incomes,” said DMACS data manager Yucheng Fan. “We saw more variation across income levels in the degree of importance placed on homelessness, crime and safety, quality jobs, and housing

Yucheng Fan

Eleven percent of Detroiters with annual household incomes of less than $30,000 listed homelessness as one of their top priorities for the U.S. government to address, compared to 4% of Detroiters with annual household incomes above $30,000.

Crime and safety, quality jobs and housing are far less likely to be viewed as top issues for the U.S. government to address among higher-income Detroiters, relative to those with lower annual household incomes.

Looking at priorities by age group, equal shares of Detroiters 65 and older (14%) want the U.S. government to prioritize addressing border and immigration policy, health care, crime and safety, and cost of living and inflation.

Among Detroiters under 65, the cost of living and inflation stood apart as the issue mentioned more than any other, with 23% of people under 40 and 21% of people aged 40-64 saying it’s a top priority.

Michigan metro areas divided on views on legal immigration, U-M survey shows

Contact: Lauren Slagter, lslag@umich.edu

Immigration consistently shows up as the most important problem facing the U.S. in national public opinion polls, but less information has been available to understand how Michiganders view immigration.

With Michigan poised to be one of the most influential states in the November presidential election, the Detroit Metro Area Communities Study and Michigan Metro Area Communities Study at the University of Michigan surveyed residents across the state about their attitudes toward immigration.

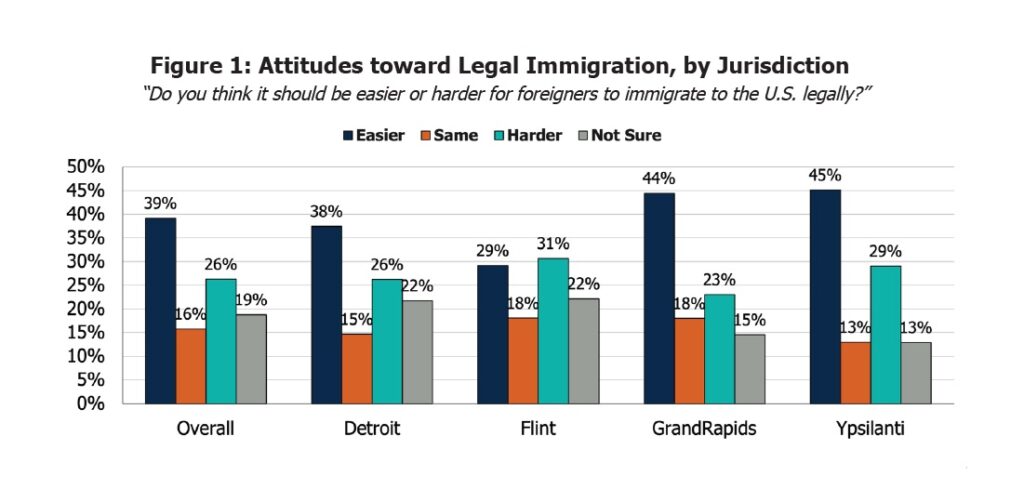

Overall, residents in Detroit, Flint, Grand Rapids and Ypsilanti were divided on legal immigration. Across the four metro areas:

- 39% of residents said it should be easier for foreigners to legally immigrate to the U.S.

- 16% said immigration policies should remain the same,

- 26% said it should be harder for foreigners to legally immigrate to the U.S.

- 19% were not sure

Ypsilanti residents (45%) and Grand Rapids residents (44%) were more likely than residents of Detroit (37%) and Flint (29%) to favor making legal immigration easier. On the other end of the spectrum, 31% of Flint residents, 29% of Ypsilanti residents, 26% of Detroit residents and 23% of Grand Rapids residents said it should be more difficult for foreigners to immigrate to the U.S. legally.

“The entire state of Michigan is considered a border zone because of its proximity to Canada, and immigration is a factor in how elected officials and community leaders have sought to reinvigorate local economies. Understanding how Michiganders think about immigration can inform policy discussions going forward,” said Yucheng Fan, data manager at the Detroit Metro Area Communities Study.

A new brief, “How Michiganders are Thinking about Immigration,” examines trends in attitudes about immigration based on people’s educational attainment and their proximity to foreign-born residents. The work was supported by the Knight Foundation, Ballmer Group, Kresge Foundation, U-M’s Poverty Solutions and Michigan CEAL.

Overall, 55% of residents with a bachelor’s degree living in Detroit, Flint, Grand Rapids and Ypsilanti supported making it easier for foreigners to immigrate to the U.S. legally, compared to only 34% of residents of these cities who did not have a bachelor’s degree. Residents who did not have a bachelor’s degree (29%) were more likely than residents with a bachelor’s degree (18%) to believe it should be harder for foreigners to immigrate to the U.S. legally.

However, residents of these cities without a bachelor’s degree (21%) were also more likely than residents with a bachelor’s degree (12%) to say that they were not sure of their views on U.S. immigration policy. Residents with and without a college degree were equally as likely to say immigration policy should remain the same.

“The surveys also found U.S.-born residents living in neighborhoods with more immigrants tend to have more favorable attitudes toward immigration. This is consistent with past research, and it shows that people who likely have more sustained contact with immigrants have a more positive view of immigration,” said Mara Ostfeld, a faculty lead at the Detroit Metro Area Communities Study.

On average, for every 10 percentage-point increase in the share of a census tract’s population that is foreign-born, there is a roughly three percentage-point increase in the degree to which U.S.-born residents support making it easier for immigrants to enter the country legally.

U-M study: Detroit’s Black homeowners gained nearly $3B in real estate wealth from 2014-22

University of Michigan Professor Jeffrey Morenoff (left) stands with Detroit Mayor Mike Duggan (center) and other speakers at a press conference on April 16, 2024, about Morenoff’s findings on how Detroit home values changed from 2014 to 2022. (Photo courtesy of City of Detroit)

Release from the City of Detroit

DETROIT – Today, Mayor Mike Duggan and City Council members joined with Detroit residents and real estate agents to celebrate a major milestone for Detroit’s Black homeowners: nearly $3 billion in added home wealth since 2014 for those who stayed in the city.

A comprehensive new study released today by the University of Michigan’s Poverty Solutions concluded that Black homeowner-occupants in Detroit amassed $2.8 billion in added home value between 2014 and 2022, which represents an 80% increase during that time. The study analyzed changes in Detroit’s housing values for the nine-year period following the city’s municipal bankruptcy to understand how much growth there has been and whether that growth has been equitably distributed across neighborhoods and racial/ethnic populations.

The study was led by Jeffrey D. Morenoff, who is a professor and associate dean at the Gerald R. Ford School of Public Policy and professor in the Department of Sociology and Population Studies Center at the University of Michigan. Demographer and Founder of Data Driven Detroit Kurt Metzger and City of Detroit Financial Analyst Christina Shaw co-authored the report.

According to the study’s findings, the net value of all owner-occupied homes increased from $4.2 billion in 2014 to $8.1 billion in 2022, a $3.9 billion/94% increase in housing wealth over these nine years. It also estimates Black homeowners realized the vast majority of that gain in wealth, with their home values rising from $3.4 billion in 2014 to $6.2 billion in 2022, a $2.8 billion jump.

“For the past nine years, the active members of 600 organized block clubs and neighborhood associations in the city have been working to rebuild their neighborhoods. The $3 billion in new home wealth they have created and earned is a direct result of their dedication and hard work,” said Mayor Mike Duggan.

Ken Scott, past president of the Greater Detroit Realtist Association and Detroit Association of Realtors and a HUD certified housing counselor, said the study matches what he and his fellow realtors have been seeing over the past several years.

“There has been a huge shift for the better in Detroit’s home values, driven largely by the improvements being made in neighborhoods. My fellow realtors and I have been seeing this shift for years. Black-owned homes are rising in value and Black families are gaining the most family wealth,” said Scott. “And while home values have risen dramatically, there is a lot of growth yet to come. Detroit homes are beautiful and dollar-for-dollar still a great value.”

Scott also praised programs that create new homeowners, like Detroit’s Down Payment Assistance Program, which was funded by the American Rescue Plan Act and provides grants of up to $25,000 to help with closing costs and other costs associated with home purchases to make homeownership more accessible and affordable. So far, the program has created nearly 500 new homeowners in Detroit – most of them Black. A second round of the program is expected to open in June.

Lowest value areas saw greatest increase

The U-M study shows that neighborhoods that were at their lowest point in 2014 have risen the most in value. Neighborhoods that had the lowest values in 2014 saw a nearly 300% increase in value in 2022, while those areas of comparatively middle and high value saw increases of 99% and 131%, respectively.

“Home values grew the most from 2014 to 2022 in neighborhoods with the lowest property values and highest poverty rates in 2014,” the study says. “Neighborhoods with high concentrations of Hispanic/Latino populations, especially those in Southwest Detroit, experienced some of the largest increases in home values over the nine-year time period. The growth in home values was geographically dispersed in neighborhoods throughout the city rather than being concentrated in neighborhoods in the downtown and midtown areas.”

In the Condon neighborhood, which saw one of the largest rises in value, the average home sale price in 2014 was about $7,500. By 2022, the average home sale had soared to more than $71,000 – an increase of 853%. Other neighborhoods in the city, including Jefferson/Mack, Kettering, Springwells and Davison, saw increases of 300% or more.

The mayor attributed the neighborhood rebound to committed residents who fought for their communities and did the hard work to keep them stable as the city worked to recover. He also credited city employees for a series of neighborhood improvements that have contributed significantly to rising home values, including:

- Renovation of more than 170 city parks and recreation centers

- Removal of 25,000 dangerous vacant homes

- Renovation and re-occupancy of 15,000 salvageable vacant homes

- Sale of 25,000 vacant side lots to adjacent homeowners

- Cleaning of 3,000 overgrown and trash-filled alleys

- Commercial blight removal and corridor cleanup

- New neighborhood streetscapes bringing back small businesses

- 167 new Motor City Match businesses open across the city

- Safer neighborhood streets thanks to installation of 10,000 speed humps

- Programs like Renew Detroit, 0% Interest Home Improvement Loan Program to address critical repairs and to help keep longtime Detroiters in their homes.

The study also cited the dramatic reduction in tax foreclosures in Detroit as a key factor in determining the net wealth gain. Since 2016, the city and a coalition of partners has helped to reduce tax foreclosures by 95%, also helping to keep thousands more longtime Detroiters in possession of their homes. Those partners have included:

- The Rocket Community Fund

- Gilbert Family Foundation

- U-SNAP-BAC

- Eastside Community Network

- Bailey Park

- Hannan Center

- Central Detroit Christian

- Cody Rouge Community Action Alliance

- Bridging Communities

- MiWealth

- United Community Housing Coalition

- Wayne Metro

- Accounting Aid Society

U-M survey: Majority of Flint residents support reparations for Black Americans

Contact: Lauren Slagter, lslag@umich.edu

FLINT—The majority of Flint residents support reparations for Black Americans, although levels of support vary depending on whether the proposal refers to reparations as a broad concept or specific reparative policies like cash payments or financial support for housing and education.

A new report from the University of Michigan’s Center for Racial Justice summarizes Flint residents’ attitudes about reparations, based on a representative survey conducted by the Michigan Metro Area Communities Study.

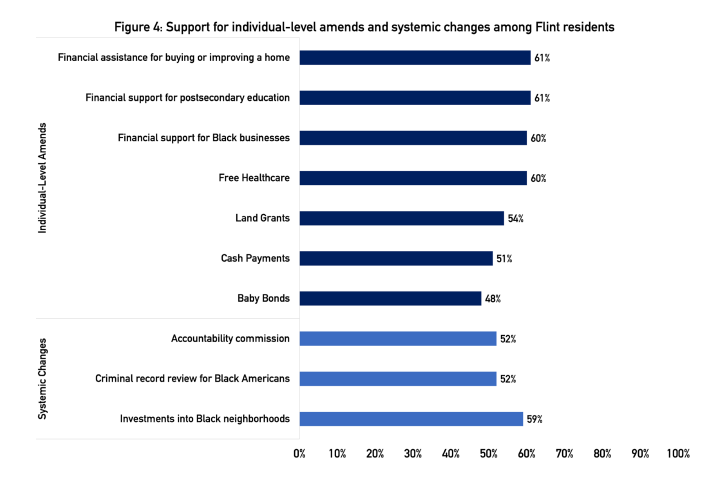

The survey shows 53% of Flint residents support the idea of governments making amends to Black Americans, while 22% neither support nor oppose it, 22% oppose it, and 3% don’t know or didn’t answer the survey question. However, a larger share of Flint residents (71%) support at least one of the specific reparative policies targeted toward individuals.

Among the Flint residents who opposed the general idea of reparations, 30% supported the specific action of governments offering financial assistance for buying or improving a home, 26% were in favor of financial support for postsecondary education, 26% supported free health care, and 17% supported the idea of cash payments for Black Americans.

“Reparations is where history meets action,” said Erykah Benson, a research fellow at the Center for Racial Justice. “The findings show how language plays a key role in attitudes toward reparations. It reveals how many Flint residents recognize that the impact of structural racism, past and present, extends to various areas of society, including as health care, homeownership, business ownership, wealth-building, criminal justice and more.”

Benson co-authored the report, “Forty acres and a mule? How Flint residents believe the government should repay Black Americans,” with Jasmine Simington, a research fellow at CRJ.

Residents and community leaders in Flint are working with U-M to explore what community-based reparations for Black residents might look like, as part of a national reparations project called Crafting Democratic Futures.

The chart shows the percentage of Flint residents who support different forms of reparations, according to a survey by the Michigan Metro Area Communities Study.

In the Michigan Metro Area Communities Study, reparations are defined as governmental action to make amends to Black Americans for the ongoing harm caused by slavery and more recent discriminatory policies. The survey asked about the general idea of governments making amends, as well as specific reparative policies that are either aimed at individual Black Americans or larger systemic changes.

“This report offers nuanced insights into how Flint residents think about reparations, whether that’s in the form of cash payments, financial assistance for improving or buying a house, investing in historically Black neighborhoods, or other options. We can focus on community-based reparations proposals that align with Flint residents’ priorities,” said Asa Zuccaro, director of the Latinx Technology and Community Center in Flint and a community fellow for the Crafting Democratic Futures project.

Race, education and income figured prominently into Flint residents’ attitudes toward reparations, with Black residents, residents with higher incomes and residents with more formal education showing higher levels of support for efforts to make amends to Black Americans.

About 57% of Flint’s more than 79,800 residents are Black, and about 33% of residents are white. More than two-thirds of the city’s Black residents support reparations (67%), compared to just under one-third (31%) of white residents.

Flint residents with a bachelor’s degree or more higher education are more likely to support reparations (74%), compared to residents with some college (60%) and residents with a high school education or less (43%). Residents with a household income of at least $60,000 are more likely to support reparations (73%), compared to residents with an income between $30,000 and $59,999 (46%) and those with an income of less than $30,000 (50%). The median household income in Flint is $32,350.

Options for individual-level amends asked about on the survey included:

- Financial support for postsecondary education (61% of Flint residents support this approach)

- Financial assistance for buying or improving a home (61% support)

- Financial support for Black-owned businesses (60% support)

- Free health care (60% support)

- Land grants (54% support)

- Cash payments (51% support)

- Baby bonds, where the government establishes a savings account for a newborn and invests in it throughout their childhood (48%)

A majority of Black Flint residents, the intended beneficiaries of the reparations policies under consideration, support cash payments (73%). An even greater proportion of Black residents (78%) support reparations in the form of financial assistance for buying or improving a home, financial support for postsecondary education (77%), financial support for Black businesses (75%) or free health care (74%).

Options for systemic-level amends asked about on the survey included:

- Investments into historically Black neighborhoods harmed by economic and environmental discrimination (59%)

- Expedited review and expungement of eligible criminal records for Black Americans (52%)

- Creation of an accountability commission that seeks to hold governments accountable for the ways that slavery and discriminatory policies have harmed Black Americans (52%)

“To Flint residents, reparations doesn’t mean one thing,” Simington said. “There are a variety of approaches local and national governments can take to making amends to Black Americans at an individual level or through systemic change. The approaches need not be mutually exclusive, and residents’ priorities should guide efforts.”

Q&A: What does guaranteed income mean for Ann Arbor?

Guaranteed income programs are popping up across the country, including the University of Michigan’s hometown of Ann Arbor. But what are these programs, who is eligible to participate, and how does guaranteed income address poverty and inequality?

Led by Poverty Solutions at the University of Michigan, Guaranteed Income to Grow Ann Arbor (GIG A2) is a two-year guaranteed income pilot to provide monthly payments of $528 to 100 entrepreneurs with low and very low incomes in Ann Arbor. The City of Ann Arbor selected U-M to implement the pilot and study its effects, and GIG A2 is accepting applications in October.

Kristin Seefeldt

“This guaranteed income pilot is about celebrating residents who do much to strengthen our community but are still struggling to make ends meet,” said Kristin Seefeldt, associate director of Poverty Solutions, in an official announcement of the program. “Pilot participants are vital to the success of the research study, which will allow other communities across the country to learn from Ann Arbor’s approach to guaranteed income.”

Here, the three U-M faculty researchers leading the pilot program discuss the idea behind guaranteed income and the GIG A2 pilot program goals.

Kristin Seefeldt is an associate professor of social work at the U-M School of Social Work, with a courtesy appointment at U-M’s Gerald R. Ford School of Public Policy. Seefeldt is also the principal investigator for GIG A2.

William Lopez

William Lopez is a clinical assistant professor of health behavior and health education at the U-M School of Public Health and Faculty Associate in the Latina/o Studies Program. Lopez is also a co-principal investigator for GIG A2 and a senior advisor at Poverty Solutions.

Rebeccah Sokol is an assistant professor of social work at the U-M School of Social Work. Sokol is also an adjunct assistant professor of health behavior and health education at the U-M School of Public Health and a co-principal investigator for GIG A2.

What is guaranteed income?

Sokol: Guaranteed income is a cash transfer program that provides regular, unconditional, and unrestricted funds to individuals or households. Recipients can spend the money however they would like without requiring that they perform specific activities—like working or going to school—to remain eligible.

Rebeccah Sokol

Guaranteed income is always unconditional. Recipients do not need to perform specific behaviors to continue receiving funds. The program may, however, focus on certain people. For example, a guaranteed income program may focus on people who earn an income below a certain threshold.

In Guaranteed Income to Grow Ann Arbor, we are implementing a guaranteed income program that is focused on entrepreneurs in Ann Arbor who qualify as low-income earners. We are not requiring, however, that these individuals continue working to continue receiving their monthly guaranteed income payments.

What do these types of programs seek to achieve and how do they benefit individuals within (and maybe outside) of the program?

Seefeldt: These programs seek to provide people with a stable and dependable income. We know that many people who work lower-paying jobs also experience great variability in their scheduled hours week-to-week. This means that their pay varies as well, making it difficult to plan and manage finances. Having a reliable source of income, and one that can be flexibly used, may help mitigate some of the stress associated with unstable pay and lower the likelihood of experiencing hardships such as food and housing insecurity.

There could be a number of positive spillover effects of guaranteed income to the larger community, including for people not receiving payments. The payment may be used to help support extended family and friend networks. Many recipients will use the money to purchase goods and services, which is important to keeping the economy going.

Lopez: It’s also critical to remember that guaranteed income programs are fundamentally community health programs. Individuals and their families often know best what is needed to keep them healthy and happy. Unrestricted income allows them to spend that money on things like meals, medicines, fuel, child care, or even socializing. We often think of health interventions as interventions that specifically increase access to medications or to medical care, but there are many other aspects of our lives that actually keep us healthy. For members of marginalized communities, maintaining their health often requires navigating government systems working against them; and there are rarely, if ever, government programs to support maintaining one’s health in this way. For example, families who accrued debt while incarcerated may be able to pay down debt, or those who need a lawyer to fight deportation may be able to afford to hire one. Unrestricted cash allows families to prioritize these aspects as they see fit.

Where else in the U.S. are guaranteed income programs happening?

Seefeldt: Currently more than 100 cities have run—or are in the process of running—guaranteed income pilots. There are guaranteed income pilots planned and happening in communities across the United States, including Flint, Michigan; Stockton, California; Philadelphia, Pennsylvania; and New Orleans, Louisiana.

Lopez: Importantly, guaranteed income programs are not just—nor primarily—an academic idea. There is a growing movement throughout the country for more cities to embrace guaranteed income programs as a means of addressing economic disparities and the harms to health and well-being that often accompany poverty. Guaranteed income is rooted in the simple idea that every human being deserves to have their basic needs met, no matter what, and that unrestricted income empowers individuals and families to decide how to meet these needs.

What are some of the questions you’ve grappled with so far in designing the study?

Seefeldt: One issue that continually comes up is how to design a pilot that isn’t overly bureaucratic. A common complaint about many social service programs in the U.S. is that they require applicants and recipients to jump through many hoops in order to receive a benefit. Some refer to this practice as “administrative burden.” We don’t want the GIG A2 application process to be overly burdensome; we don’t want anyone to be deterred from applying because the application seems daunting and requires too many forms of documentation.

On the other hand, we have a responsibility to make sure that the funds for this pilot are spent in an ethical and responsible manner. Part of doing so means making sure that the pilot is serving those whom it was intended to serve and being accountable to the federal government to make sure that taxpayer dollars go toward their intended use. Thus, we are requiring that applicants provide some documentation to support their application.

Speaker series to cover reparations, human-centered design, health impacts of oppression

Contact: Karissa Knapp, ktknapp@umich.edu

ANN ARBOR—This fall, the Real-World Perspectives on Poverty Solutions Speaker Series will feature poverty experts in both policy and practice, who will explore critical issues like: the effects of systemic oppression on health, reforming public institutions through human-centered design, reparations, and financial empowerment in Detroit.

The series is hosted by Poverty Solutions at the University of Michigan, a university-wide presidential initiative that aims to prevent and alleviate poverty through action-based research.

U-M researcher Arline Geronimus, professor of health behavior and health education at the School of Public Health, will be starting the series on Friday, Sept. 22. Geronimus will share her research on the effects of systemic oppression on the body. Her book on the subject – Weathering: The Extraordinary Stress of Ordinary Life in an Unjust Society – came out earlier this year.

Poverty Solutions is partnering with various university departments to invite this diverse set of speakers to discuss different approaches to addressing poverty in this year’s seven-week series.

All events are free and open to the public, and will take place at noon on Fridays in room ECC 1840 at the School of Social Work, unless otherwise noted. U-M students can enroll in a course to earn one credit for attending the speaker series.

Here’s the speaker series lineup:

- Sept. 22 – “Weathering: The extraordinary stress of ordinary life in an unjust society” by Arline Gerominus, professor of health behavior and health education, School of Public Health, U-M.

- Sept. 29 – “The United States pays reparations every day—just not to Black America?” by Cornell William Brooks, Hauser Professor of the Practice of Nonprofit Organizations, professor of the practice of public leadership and social justice, Harvard University.

- Oct. 6 – “The power in a single story: Scaling social change by focusing on individuals” by Adam Selzer, co-founder and senior director of Civilla Detroit.

- Oct. 13 – “Chelsea Eats: Basic income and food security” by Jeff Liebman, director of the Taubman Center for State and Local Government; Robert W. Scrivner Professor of Social Policy, Harvard University.

- Special date and location: 12:30 p.m. Oct. 18 at the Michigan Union – “Incarceration and its aftermath: How art can create pathways to reintegration and healing” by Reuben Miller and Nicole Fleetwood, MacArthur Fellows. Miller is an associate professor of social work, University of Chicago, and Fleetwood is a professor of media, New York University.

- Oct. 20 – “Creating green energy and equitable enterprise in Detroit” by Jerry Davis, Gilbert and Ruth Whitaker Professor of Business Administration, professor of management and organizations, U-M Ross School of Business.

- Oct. 27 – “Creating moves to opportunity: Experimental and mixed methods evidence on neighborhood choice” by Stefanie DeLuca, James Coleman Professor of Sociology and Social Policy, Johns Hopkins University.

- Nov. 3 – Poverty Solutions alumni panel

Applications open Oct. 2-13 for Ann Arbor’s guaranteed income for low-income entrepreneurs

Contact: Lauren Slagter, lslag@umich.edu

ANN ARBOR – Entrepreneurs, self-employed people, owners of formal or informal small businesses, gig workers, and people with side hustles who have low incomes can apply Oct. 2-13 to receive monthly payments from Guaranteed Income to Grow Ann Arbor (GIG A2).

After the application window closes, 100 eligible applicants will be randomly selected to receive payments of $528 per month for two years, starting early in 2024. Recipients can use the money however they want – no strings attached. They will be asked to complete three surveys over the course of the two-year pilot, answering questions about how they use the guaranteed income money; other experiences such as affording food, housing, and child care; and their health and well-being.

Another 100 eligible applicants will be randomly selected to participate in a research study of the guaranteed income program, but they will not receive the cash payments. They will be paid as a token of appreciation for taking similar surveys as the participants who receive the payments.

The City of Ann Arbor selected Poverty Solutions at the University of Michigan to manage the guaranteed income pilot and conduct a research study to measure its impact.

“This guaranteed income pilot is about celebrating residents who do much to strengthen our community but are still struggling to make ends meet. The funded and unfunded participants are both vital to the success of the research study, which will allow other communities across the country to learn from Ann Arbor’s approach to guaranteed income,” said Kristin Seefeldt, an associate professor of social work and public policy at U-M and associate director of Poverty Solutions, who is the lead researcher for the guaranteed income pilot.

To be eligible for the monthly payments, applicants must:

- Live in the City of Ann Arbor and be at least 18 years old.

- Have an income at or below 225% of the federal poverty line. People who currently receive or are eligible for any type of public assistance (SNAP, TANF, Section 8, Pell Grants) likely qualify.

- Be an entrepreneur, owner of a formal or informal small business, independent contractor, provide paid services informally, or a gig worker. Many different activities meet this criteria, from doing hair, to shoveling snow, to selling art and performing.

More details on eligibility and how the program works are available on the Guaranteed Income to Grow Ann Arbor website, www.giga2.org. The application will be available online, and there will be in-person opportunities in the coming weeks to learn more about the pilot and to receive assistance completing the application.

In 2022, Ann Arbor City Council allocated $1.6 million of the city’s federal American Rescue Plan Act funds to a basic income pilot. After reviewing proposals for how the pilot program could be structured and evaluated, city staff recommended partnering with U-M Poverty Solutions, and the city council signed off on the proposal in June. In August, U-M’s Institutional Review Board approved the design of the study.

The pilot is supported by several community partners, including Friends in Deed, Ann Arbor Area Community Foundation, Ann Arbor District Library, Express Your Yes Foundation, Groundcover News, and Washtenaw Community College’s Entrepreneurship Center.

Chronic housing instability poses educational risk for Detroit students

Contact: Lauren Slagter, lslag@umich.edu

DETROIT– As Detroit children prepare to return to school, widespread and chronic housing instability among city residents poses a threat to students’ ability to perform well academically.

New research from the University of Michigan’s Poverty Solutions and Wayne State University’s Detroit Partnership for Education Equity & Research (PEER) analyzed survey data with responses from more than 1,400 Detroit parents plus in-depth interviews with 20 parents identified as homeless or housing unstable. A policy brief summarizes themes from the parents’ experiences and offers policy recommendations that would promote housing stability and help ensure Detroit children have an equitable opportunity to learn.

“Having a stable place to live is the foundation of academic success and many dimensions of well-being. Unfortunately, many Detroit parents describe a rental environment where short-term leases, poor housing conditions, and few legal protections mean they face a near-constant threat of displacement. This is a problem that schools cannot solve alone,” said Jennifer Erb-Downward, director of housing programs and policy initiatives at U-M Poverty Solutions and co-author of the policy brief.

Detroit has one of the highest rates of childhood housing instability in the country, and 11% to 16% of school-aged children experience homelessness. While federal law guarantees students experiencing homelessness the right to an education, schools do not always identify when students lack stable housing, and families are not always aware of their rights. As a result, many students without a stable place to live do not get the extra support and resources they need to participate fully in school. In the 2021-22 school year, 90% of Detroit Public Schools Community District students identified as experiencing homelessness were chronically absent from school.

“It was making it where it was hard for me to get my kids to school, and I almost lost my job because we didn’t have a stable home,” said one parent interviewed by the researchers. “It was hard because at the hours I would have to be at work, they would have to be at school, so sometimes they would have to miss school and go to work with me.”

The researchers found displacement is a significant financial drain on parents with school-aged children in Detroit. In the wake of a forced move, families need to replace lost possessions and pay repeatedly for application fees and security deposits at new rentals. This extends periods of homelessness for Detroit’s children and reduces family resources available to pay for school necessities – such as gas or car repairs needed to reliably attend school.

Parents also described long-lasting repercussions that continue years after housing loss first occurs. Because eviction filings are open records, parents report that rental screening practices exclude them from the majority of stable, quality rental units, even when they meet income requirements and can pay the security deposit.

“City government and the local court system can implement changes that would increase housing stability for Detroit’s children. We have opportunities to turn the tide of chronic housing instability in Detroit,” said Sarah Winchell Lenhoff, director of Detroit PEER, associate professor of educational leadership and policy studies at Wayne State, and co-author of the policy brief.

One way to stabilize housing for families with children is to ban evictions during the school year. The researchers pointed to the city of Seattle as an example of implementing that type of targeted eviction moratorium.

All of the parents interviewed said the lack of quality affordable housing is a barrier to housing stability. To address this, the researchers recommend the city enforce its existing rental code and expand Detroit’s affordable housing stock. Plus, the 36th District Court should refuse eviction filings for rental properties that are not up to code. Nine in 10 pandemic-era evictions in Detroit occurred at properties without a Certificate of Compliance (CoC), despite Detroit’s rental code requiring properties to be inspected and receive a CoC prior to rental.

The researchers offered the following additional policy recommendations to promote housing stability in Detroit:

- Implement rental application fee limits and require application fee refunds to tenants not selected for housing, in order to prevent predatory landlords from exploiting the scarcity and urgency of the rental market

- Ensure tenants have access to remote eviction proceedings to reduce the number of default judgments against Detroit tenants who do not attend in-person hearings

- Pass just cause and right to renew legislation, which would require that landlords justify evictions and lease non-renewals with a valid legal cause

United Way Challenge invests $1M+ in pilots to expand financial opportunities for Detroiters

Attendees discuss project ideas at the Detroit Financial Well-Being Innovation Challenge showcase held April 28, 2023, at Durfee Innovation Society in Detroit. (Photo by Creative Focus Productions)

Release courtesy of United Way for Southeastern Michigan

DETROIT — United Way for Southeastern Michigan, in collaboration with Poverty Solutions at the University of Michigan, has announced the next stage of the Detroit Financial Well-Being Innovation Challenge. Out of an initial pool of over 30 entries, six unique projects have advanced to the Pilot Stage.

Over the 12-month implementation period, six Pilot Stage grantees will receive up to $200,000 and ongoing technical support. Here are the projects moving forward from the Planning Stage into the Pilot Stage:

- Bikes4Employees: Led by the Detroit Greenways Coalition, this project aims to provide high-quality bicycles to Detroiters lacking reliable transportation, reducing expenses and improving employment sustainability while also promoting health benefits and reducing stress.

- Community Investment Trusts: Under the leadership of Doing Development Differently in Metro Detroit (D4), this initiative seeks to pilot the use of Community Investment Trusts (CITs) to facilitate community ownership of real estate and build wealth in low-income communities.

- Credit Escalator: Led by GreenPath Financial Wellness, the Credit Escalator project plans to change banking systems for communities of color in Detroit. The service combines financial coaching with a personal loan, aiming to improve credit scores as the loan is repaid.

- East Chadsey Condon Alliance (ECCA): Led by the Southwest Economic Solutions Corporation, the ECCA’s Diversified Community Investment Fund (DCIF) offers all Detroiters a chance to invest in and participate in community development projects.

- Family Mobility Savings Program: Under the stewardship of Communities First (CFI), this program will jumpstart emergency savings, helping Detroiters meet their immediate needs while setting the foundation for their financial future.

- Home Repair Clearinghouse: Another initiative by Doing Development Differently in Metro Detroit (D4), this project aims to serve as a hub connecting low-income homeowners with contractors, streamlining the home repair process and advocating for homeowners.

These six projects were chosen from among 17 projects participating in the Planning Stage, which ran from Aug. 1, 2022, through March 31, 2023. During the Planning Stage, grantees worked to test assumptions critical to the success of their new ideas, develop partnerships, and create the processes and materials necessary to launch a functioning pilot. The six projects advanced to the Pilot Stage demonstrated the strongest readiness to implement and alignment to the goals of the challenge. They will kick off their pilot operations this fall. To assist them throughout the implementation process, United Way will also provide:

- Program evaluation services from University of Michigan’s Poverty Solutions.

- Tailored coaching and consultation services to enhance capacities in pilot implementation, strategic planning, marketing and communications, qualitative data collection, and more.

- Regular opportunities to exchange ideas, reflect on lessons learned from implementation, and share the impact of their work.

United Way will continue to maintain transparent communication with the grantees in the Pilot Stage, the third and penultimate stage of the innovation challenge, to identify any support needs and requests for additional technical assistance. They will also help grantees measure the efficiency and impact of the programs.

Megan Thibos, director of economic mobility at United Way for Southeastern Michigan, highlights the underlying rationale for the challenge: “Detroit residents face unjust systemic barriers to financial stability. This includes high living costs, unpredictable low incomes, and inaccessible credit. These grants aim to support the development of innovative, sustainable solutions to enhance financial opportunities for Detroiters.”

The Financial Well-Being Innovation Challenge originated from the 2020 University of Michigan Poverty Solutions report, The Financial Well-Being of Detroiters: What Do We Know? The findings revealed that a mix of low and volatile incomes and disproportionately high costs make it difficult for Detroiters to effectively manage their finances. The Challenge looks to address these systemic issues with innovative ideas that can completely change opportunities for Detroit families.

Leonymae Aumendato

Leonymae Aumentado, senior project manager at Poverty Solutions, commended the project teams on their big ideas.

“We are thrilled to continue supporting these dedicated organizations in piloting their new and game-changing programs, thoughtfully designed to improve the financial well-being of Detroiters. The Challenge itself is innovative in its approach of providing funding to build and test never-before-done program models as well as providing dedicated research and evaluation support to ensure the project teams can both do the work and rigorously measure the impact of their work,” Aumentado said.

The Detroit Financial Well-being Innovation Challenge will continue through 2026. Scale Stage grants, anticipated to be awarded in late 2024, will fund selected projects up to $1 million based on the results of the Pilot Stage.

The Challenge is made possible through funding from JPMorgan Chase, Comerica Bank, General Motors, and United Way for Southeastern Michigan.

For more details about the Detroit Financial Well-Being Innovation Challenge, visit: UnitedWaySEM.org/FWBIC. To learn more about the work of United Way for Southeastern Michigan or to contribute, visit: UnitedWaySEM.org.

About United Way for Southeastern Michigan

United Way for Southeastern Michigan, a member of the United Way Worldwide network and an independently governed 501(c)(3) nonprofit organization, works to help households across Wayne, Oakland, Macomb, and Washtenaw counties become stable and ensure children have the support they need to thrive. For more than 100 years, United Way has been a leader in creating positive, measurable, and sustainable change in communities throughout southeast Michigan. United Way works in partnership with donors, agencies, corporate and municipal partners to help families meet their basic needs of housing, food, health care and family finances, and ensure children start school ready to learn and graduate ready for life. To give, advocate, volunteer or learn more, visit UnitedWaySEM.org.

About University of Michigan’s Poverty Solutions

Poverty Solutions is a university-wide initiative at the University of Michigan that partners with communities and policymakers to find new ways to prevent and alleviate poverty through action-based research.

Poverty Solutions research assistants support groups advancing Detroit financial well-being projects

By Lauren Slagter

DETROIT – Getting money into the savings accounts of some Detroiters is more challenging than one might think. Before people can think about long-term financial planning, they need their immediate needs met. And those opening bank accounts for the first time may face hurdles gathering the necessary personal identification documents.

These were some of Communities First’s takeaways from a small-scale pilot of its new Family Mobility Savings Program that deposited money into savings accounts for eight people as compensation for completing financial literacy and job readiness tasks. Communities First was one of 16 teams participating in the Detroit Financial Well-Being Innovation Challenge that shared their progress so far at a showcase event on Friday, April 28, hosted by GreenLight Fund at Durfee Innovation Society.

The five-year challenge that launched in February 2022 is run by United Way for Southeastern Michigan in partnership with the University of Michigan’s Poverty Solutions, whose research on the financial well-being of Detroiters motivated the challenge. Six to eight of the project teams will be selected this summer to continue to the pilot stage, where they will receive additional funding and technical assistance to start implementing their ideas.

Leonymae Aumentado, senior strategic projects manager at U-M’s Poverty Solutions, talks to an attendee at the Detroit Financial Well-Being Innovation Challenge showcase held April 28, 2023, at Durfee Innovation Society in Detroit. (Photo by Creative Focus Productions)

“Not all of the organizations are going to make it to the next phase. But an event like this is really important because it helps to generate outside interest in these pilots so they can explore other paths to move forward on,” said Leonymae Aumentado, strategic projects manager at Poverty Solutions, who supports the implementation of the challenge.

At the showcase, Communities First staff outlined their plans to enroll 100 people in a six-month pilot of the Family Mobility Savings Program. To help them prepare to expand the savings program, U-M Poverty Solutions research assistant Nick Voelkner identified and analyzed barriers to financial security for Detroiters, including banks’ reliance on consumer reporting agencies to screen potential patrons, predatory lenders, overdraft fees, people’s distrust of banks, and low levels of financial literacy.

“It was really helpful and gave us different eyes to look at things,” said Ashley Strozier, family mobility coordinator at Communities First. “I’m not a data person. I’m person-to-person. The data gave me different things to aim for.”

Communities First staff discuss their project at the Detroit Financial Well-Being Innovation Challenge showcase held April 28, 2023, at Durfee Innovation Society in Detroit. (Photo by Creative Focus Productions)

In all, 14 Poverty Solutions research assistants provided support to Financial Well-Being Innovation Challenge teams, gathering information on topics ranging from community land trusts to demographics of Black workers in Detroit and the barriers faced by small business owners and entrepreneurs.

“The goal for the research assistants doing this work is to support the organizations,” said Aumentado, who oversaw their work. “I also saw it as an opportunity for the research assistants to build a set of skills that are going to be useful to them if they want to work in this type of space.”

Voelkner (MSW ‘23), a Brighton native, addressed research questions for Communities First as well as Southwest Economic Solutions and GenesisHOPE. This was his first time working on financial well-being issues, and he was struck by how many banking policies benefit only the financial institution while negatively affecting people’s ability to accumulate savings.

“Everything I’ve learned from Poverty Solutions has been so helpful,” Voelkner said. “It’s not only the memo writing, but how to structure it and convey information in a way that’s accessible and understandable and how to select information that’s really relevant.”

Poverty Solutions Research Assistant Nick Voelkner talks to an attendee at the Detroit Financial Well-Being Innovation Challenge showcase held April 28, 2023, at Durfee Innovation Society in Detroit. (Photo by Creative Focus Productions)

Kyra Reumann-Moore (MPA ‘23), originally of Philadelphia, said she also appreciated the experience she gained writing policy memos and analyzing qualitative research. She worked on research questions for the National Black Worker Center, a Black workers’ rights advocacy organization with 10 centers across the country and nine more centers in an incubation phase.

The organization is exploring opening a Detroit location, so Reumann-Moore gathered information on Black worker demographics, employment levels, and wages in Detroit as well as the history of the local labor movement and the migration of Black workers to Detroit. The research memo was so helpful that LaRonda Schenck Scott, development director for the National Black Worker Center, said she’s interested in having Reumann-Moore complete similar research for the other nine cities incubating Black Worker Centers.

“I gained a lot of knowledge that will be transferable to how I go about understanding the context of different cities,” Reumann-Moore said. “I love how community-centric the challenge is and how they are trying to improve the financial well-being of Detroiters based on what they’re hearing from residents.”

Poverty Solutions Research Assistant Kyra Reumann-Moore (left) listens to a presentation at the Detroit Financial Well-Being Innovation Challenge showcase held April 28, 2023, at Durfee Innovation Society in Detroit. (Photo by Creative Focus Productions)

Interested in more news like this? Subscribe to the Poverty Solutions Detroit Partnership on Economic Mobility newsletter.