Research shows far-reaching costs of eviction filings to tenants – regardless of the outcome in court

Contact:

Lauren Slagter, University of Michigan, lslag@umich.edu

Zakya Hall, Community Legal Services of Philadelphia, zhall@clsphila.org

A new study from the University of Michigan documents the far-reaching costs of eviction filings for Pennsylvania tenants who had eviction cases filed against them but experienced a “best-case scenario” in court, meaning they had legal representation and their cases were dismissed, withdrawn, or won.

Eviction court filings negatively impacted the health, housing stability, and economic prosperity of tenants years beyond their court date – even when the case did not result in an eviction judgment against the tenant. In the study, tenants listed the costs and losses they experienced after an eviction filing and rated the degree of impact of the various costs and losses.

Alexa Eisenberg

“Simply being named in an eviction complaint is enough to trigger a cascade of consequences that cause lasting harm to tenants and their families,” said Alexa Eisenberg, a research fellow and lecturer at U-M’s School of Public Health. “The collateral costs of eviction filings are not inevitable. State legislators can automatically seal eviction records from public view and implement other immediate policy changes that can mitigate the harm of eviction records and support the stability and well-being of residents across the state.”

Eisenberg co-authored a report, “Record Costs: Collateral Consequences of Eviction Court Filings in Pennsylvania,” with Kate Brantley, a research area specialist at U-M’s Housing Solutions for Health Equity. The research was supported by Community Legal Services of Philadelphia and Poverty Solutions at U-M.

Landlords increasingly rely on tenant screening companies and internet searches to apply blanket denials of applicants with eviction records. Eight in 10 research participants said their eviction filing limited their future housing options and prolonged their housing instability. Among the tenants who moved after facing an eviction filing, 65% said a prospective landlord asked about their eviction record, and over half said a landlord explicitly denied the tenant’s application because of their eviction filing. Tenants pay each time they submit a rental application, so unsuccessful applications rack up excess fees.

“(W)hen we go to find new housing, we can’t because we have these (filings) on our records, and that’s wrong … I won (my) case … and it’s still following me. Why?” said one tenant in the study.

Kate Brantley

Some tenants with eviction records moved into substandard or hazardous units in order to avoid or emerge from homelessness. Participants in the study who remained in their housing were generally dissatisfied with their housing quality and endured persistent eviction threats. Most said they would move to a better housing situation if they could, yet the majority did not search and many anticipated challenges securing new housing they could afford.

“Eviction records are not merely a reflection of renters’ instability — they are also a cause of it,” Brantley said. “Punitive filing and landlord screening practices exacerbate the effects of Pennsylvania’s housing crisis, making it nearly impossible for tenants with eviction records to find safe, decent, and affordable housing for their families.”

Holly Beck

“This research shows what we hear over and over from the tenants we represent: that even when a tenant wins in court, they are routinely denied for rental housing because it’s the eviction filing itself that is reported to future landlords,” said Holly Beck, divisional supervising attorney at Community Legal Services of Philadelphia.

The researchers point to ways Pennsylvania legislators can stabilize communities and reduce the long-term costs of eviction filings, stressing the importance of passing legislation to seal eviction records – especially for cases that are dismissed, withdrawn, or won by the tenant. Currently, eviction court filings remain public record indefinitely in Pennsylvania, even when the records are incomplete or inaccurate and regardless of case outcomes.

“Because tenant screening companies can scrape eviction records as soon as the information is public, sealing at the point of filing is the most effective approach to limiting unfair tenant screening practices,“ Eisenberg said. “Landlords’ use of tenant screening not only exacerbates housing instability, it also perpetuates housing discrimination against Black women and children who are disproportionately filed against. Sealing eviction records is a housing justice priority.”

Detroiters’ perceptions of their neighborhoods shifted after Strategic Neighborhood Fund investments

The map shows the Detroit neighborhoods that received targeted infrastructure improvements through the Strategic Neighborhood Fund.

Contact: Lauren Slagter, lslag@umich.edu

DETROIT – A study drawing on survey data from the past five years shows that while neighborhood satisfaction fell across Detroit as the pandemic unfolded, neighborhoods that had received targeted infrastructure improvements proved more resilient.

The survey data reported by University of Michigan researchers showed the onset of the COVID-19 pandemic in 2020 changed Detroiters’ relationships with their neighborhoods, ushering in an overall decline in satisfaction likely linked to the closure of businesses, stay-at-home orders, the financial toll of the economic shutdown, and rising rates of infection and death.

The decline in satisfaction was most pronounced in neighborhoods that had not received $262 million in targeted infrastructure investments from the City of Detroit, Invest Detroit, and its partners as part of the Strategic Neighborhood Fund program.

Lydia Wileden

“The pandemic clearly shaped how Detroiters view their neighborhoods and challenged residents’ sense of local progress. However, our findings show that people’s sense of neighborhood change largely stalled during the pandemic rather than reversing altogether,” said Lydia Wileden, a research associate at U-M’s Detroit Metro Area Communities Study. “This means that rather than losing ground, local investments may have helped stabilize communities during that tumultuous time.”

Wileden, also a postdoctoral scholar at the University of Chicago’s Mansueto Institute for Urban Innovation, authored a series of reports on the survey data.

The later surveys – in 2022 and 2023 – document the emergence of a “new normal,” when residents’ satisfaction with their neighborhoods, change in quality of life, and perceived change in neighborhood remain mostly level.

In other areas – satisfaction with amenities like the availability of parks and playgrounds and the conditions of streets and sidewalks – resident sentiments rebounded to pre-pandemic levels. Resident perceptions showed signs of positive change related to perceived change in population and neighborhood attractiveness.

The Strategic Neighborhood Fund program is a place-based investment effort to develop dense, safe, mixed-income neighborhoods that boost economic opportunity and improve the quality of life for residents. The Strategic Neighborhood Fund is managed by Invest Detroit and consists of a mix of public and philanthropic dollars, plus loans. The program has directed investment to 10 neighborhoods in Detroit mainly via funding for infrastructure improvements, including park improvements, streetscape improvements, commercial corridor development, and the development of affordable single-family housing.

In 2016, the Strategic Neighborhood Fund began investing in Detroit’s Southwest/Vernor, Livernois/McNichols, and Islandview/Greater Villages neighborhoods. In 2018, the fund started directing resources to seven more neighborhoods: Grand River/Northwest, Warrendale/Cody Rouge, Russell Woods/Nardin Park, Campau/Banglatown, Jefferson Chalmers, East Warren/Cadieux, and Gratiot/7 Mile.

The Gilbert Family Foundation announced in May a $15 million commitment to kick off a third phase of Strategic Neighborhood Fund investments in the same 10 neighborhoods.

In 2019, 69% of Detroiters said they were satisfied with their neighborhood compared to 62% in 2023. The decline in satisfaction was most pronounced in neighborhoods that had not received targeted infrastructure investments, where satisfaction fell from 69% in 2019 to 60% in 2023.

Over the same time period, satisfaction fell from 80% to 71% in the first set of neighborhoods that received Strategic Neighborhood Fund investments (SNF 1.0), from 74% to 70% in the more advantaged second set of neighborhoods that received the investments (SNF 2.1), and from 58% to 51% in the less advantaged second set neighborhoods that received the investments (SNF 2.2).

Jermaine Ruffin

“It’s invaluable to know what residents think of the changes in their neighborhoods made by Strategic Neighborhood Fund investments. The University of Michigan’s Detroit Metro Area Communities Study gives us a unique tool to understand neighborhood revitalization efforts through the eyes of residents as the investments are happening and in the years afterward,” said Jermaine Ruffin, Invest Detroit’s senior vice president of neighborhoods.

The Detroit Metro Area Communities Study started to survey Detroiters about their neighborhoods in 2019, when initial investments in the first set of neighborhoods were coming to fruition and investments in the second set of neighborhoods were still in the planning phase. The surveys continued in 2021, 2022, and 2023 and asked about:

- neighborhood satisfaction;

- quality of life;

- neighborhood reputation;

- satisfaction with neighborhood amenities like affordable housing, stores, condition of streets and sidewalks, and public facilities;

- change over time in neighborhood attractiveness, population, and business presences;

- change over time in rent costs and housing values; and

- perceptions of crime and safety.

In all, the surveys captured nearly 9,000 observations across four points of time from 4,012 Detroiters.

In addition to the over-time analysis, titled “Examining Neighborhood Sentiments Among Residents of SNF Neighborhoods Over Time,” the research team is releasing four reports that summarize variation in resident sentiments related to the Strategic Neighborhood Fund investments for each study year. Those reports can be found here:

U-M experts explore ramifications of housing crisis on economy, emotional well-being and more

Contact: Jeff Karoub, jkaroub@umich.edu; Matt Trevor, mtrevor@umich.edu

ANN ARBOR—The need for affordable and accessible housing is an issue that transcends political affiliation—even as it rises in significance to voters—and matters as much to our emotional and mental health as our financial well-being.

Two University of Michigan experts—Brian Connolly, assistant professor of business law, and Jennifer Erb-Downward, director of housing stability programs and policy initiatives at Poverty Solutions—appeared on the latest episode of the Business & Society podcast to discuss their research and thoughts on the housing crisis.

Throughout the discussion, they explored research and insights on the causes of the crisis, some adverse effects on the average American and its implications for the upcoming presidential election.

One major challenge facing the housing market is rent: Roughly 20 million renter-occupied households qualify as being cost-burdened by housing, meaning they spend about 30% of their pre-tax income on rent. Throughout the discussion, Connolly and Erb-Downward identify several factors contributing to this struggle.

They agree renters face challenges of quantity and quality. First, there are simply not enough rental properties. Second, many properties are still counted as rentable units despite their unlivable condition, giving policymakers and business leaders an inaccurate picture of supply.

“I think there’s also a misunderstanding, particularly in low-income communities, about the housing supply from the standpoint of quality,” Erb-Downward said. “We talk about the degradation of older housing and the loss of housing units. But then when we look at information, say from the census or other sources, a lot of times those older units will still be counted in that supply even if they are unlivable because we don’t have a good way of tracking livable housing—and that’s a really important piece of the equation when we’re thinking about people’s actual access to housing supply.”

Connolly said quality is not the only statistical anomaly in the housing crisis. Although 20 million renter-occupied households meet the 30% of income rent-burdened status, a significant portion of that population uses more than 50% of their income on housing costs.

This shows that skyrocketing rent prices are affecting a large population of Americans more than the reporting would have policymakers and business leaders believe.

Erb-Downward notes such extreme housing cost burdens have some detrimental effects on mental health, education outcomes and social-emotional development. Particularly as the largest group of people experiencing homelessness and nonpermanent housing are children.

Connolly says housing is usually more of a local political concern. However, as recently shown in the Michigan Ross Financial Times poll, it’s more significant in this election than in years past.

“If there is any bipartisan issue, it might be housing right now because when we look across the country, and we see actions that different states are taking and whether it’s a red or a blue state, they look fairly similar,” he said. “It just goes to show how nationalized this issue has become.”

The episode closes with a discussion on the increased cost of living in major cities like New York, Los Angeles and Chicago. The cost of living challenges that have struck these cities serve as a warning for cities like Detroit and Ann Arbor.

The panel discusses how the lessons of cost-of-living increases, gentrification and real estate development can shape the future of urban planning, the real estate industry and public policy locally and nationally.

Business & Society is co-produced by JT Godfrey of the Ross School of Business and Jeff Karoub of Michigan News, and hosted by Karoub. The audio engineer is Jonah Brockman.

Survey shows how Detroiters’ mental health has changed since pandemic

Contact: Lauren Slagter, lslag@umich.edu; Jared Wadley, jwadley@umich.edu

DETROIT—Detroiters’ mental health-related symptoms have improved and largely stabilized since the peak of the COVID-19 pandemic, according to a University of Michigan report.

While the negative impacts of the pandemic on people’s mental health are well documented, less is known about the persistence of mental health problems after the lockdowns ended and the economy reopened.

U-M’s Detroit Metro Area Communities Study, with support from Poverty Solutions, surveyed Detroiters about their mental health from April 2020 through December 2023. Results from the representative survey are weighted to reflect Detroit’s population.

New analysis of the survey data shows that while substantial percentages of Detroiters still report experiencing symptoms of depression, anxiety or general worry, the numbers have largely stabilized in the post-pandemic period.

“Understanding how mental health changed during a time of crisis and since stabilized can help mental health practitioners better meet the needs of their communities,” said Lauren Chojnacki, research associate at DMACS, who authored the report, “The Mental Health of Detroiters Has Improved Since the COVID-19 Pandemic.”

Early in the pandemic, in April 2020, a majority of Detroiters (62%) reported experiencing anxiety, 47% reported feeling depressed and 46% reported feeling “general worry.”

By June 2020, 44% of Detroiters said they felt anxiety, and the percentage has remained relatively stable since then. Rates of depression dropped to 35% by August 2023 before spiking to 41% in December 2023. Feelings of general worry declined to 37% of Detroiters in June 2020, and the rate has remained relatively stable since then.

The drop in depression, anxiety and worry since the peak of the pandemic applied to Black, white, and Latino Detroiters. Women generally were more likely than men to report experiencing poor mental health one or more days a week.

Detroiters with low incomes (annual household income under $10,000) consistently report higher rates of anxiety, depression and general worry than residents with annual household incomes of $100,000 or higher.

Residents under age 30 generally have higher rates of depression, anxiety and worry than Detroiters over 65, and this persisted from the peak of the pandemic in April 2020 through December 2023.

Report: The Mental Health of Detroiters Has Improved Since the COVID-19 Pandemic

Housing crisis in Michigan: Report explores who owns, rents, has no home; examines racial gaps

Contact: Kim North Shine, kshine@umich.edu

ANN ARBOR—The burgeoning housing crisis affecting Michigan and much of the nation is addressed in a new report by the University of Michigan in partnership with the Michigan State Housing Development Authority.

“The data in the report reveals a landscape of critical challenges and opportunities in supply, demand, quality, affordability and stability,” said Roshanak Mehdipanah, an associate professor at U-M’s School of Public Health and director of Housing Solutions for Health Equity, whose team gathered and analyzed the data.

“Against the backdrop of COVID-19 recovery, rising concerns over nationwide housing unaffordability and insecurity add urgency to our state’s housing discourse.”

The challenges remain especially profound for Black Michiganders who are part of a stark 34-point gap in home ownership that has 79% of white households owning their home compared to just 45% of Black households—one of many findings that highlight racial disparities.

“This is a clear indication that systemic inequalities need to be addressed,” Mehdipanah said. “Addressing racial inequities in homeownership is critical in closing the racial wealth gap, as homeownership serves as an important means for intergenerational wealth accumulation and stability, offering families the opportunity to build equity, access credit and secure financial futures.”

The report, “2024 Michigan Statewide Housing Needs Assessment,” delves into a decade of data around the complexities of housing availability, affordability and accessibility—information city officials, urban planners, county commissioners, the public and anyone working in housing or in housing solutions can use to make informed decisions.

To that end, the report also details case studies that “highlight local innovations that respond to some of Michigan’s housing challenges.” Each case study features a housing-focused organization’s success story.

“Data such as reduction in tax foreclosure rates tells us there is promise in housing-focused interventions, particularly those developed and implemented with community organizations working closely with residents on these issues,” Mehdipanah said.

David Allen, manager of the Office of Market Research at the Michigan State Housing Development Authority, said the intent of the assessment is to “provide pivotal data and analysis on a wide range of factors that impact Michiganders’ ability to obtain necessary shelter.”

“It can be used by a variety of stakeholders in the state’s housing ecosystem to better target resources and efforts to ensure that our families and individuals can enjoy a secure home, better health and a more inclusive economy,” he said.

In addition to Allen and Mehdipanah, who is also co-lead for the Public Health IDEAS for Creating Healthy and Equitable Cities initiative, other authors of the report include U-M Housing Solutions for Health Equity team members. Kate Brantley is a research area specialist, whose work focuses on housing stability and eviction, and Melika Belhaj is the program manager whose research has focused on foreclosure, speculator behavior, naturally occurring affordable housing and low-income home ownership program outcomes in Detroit.

The group presented the report at the Building Michigan Communities conference this week.

“Our findings confirm what many already know—Michiganders with the lowest incomes disproportionately face the greatest barriers to securing safe and affordable housing,” Belhaj said. “Our analysis reveals a 34-percentage-point homeownership gap between Black and white households, underscoring the lasting impact of U.S. housing policies, such as redlining, which imposed racialized segregation in the housing market.”

The report is divided into four sections: housing inventory, housing demand, housing affordability, and housing instability and homelessness. Each section weaves in eight priority areas: equity and racial justice, housing ecosystem, preventing and ending homelessness, housing stock, older adult housing, rental housing, homeownership and communication and education.

In addition to examining data across a 10-year timespan, the analysis focuses on the years 2017, 2019, 2021 and 2022. According to the report, “these years mark pivotal points in the housing ecosystem: 2017, nearly two years after the tax foreclosure crisis began to subside; 2019, the year before the global COVID-19 pandemic; 2021, during the height of the pandemic; and 2022.”

Key findings include:

- In 2022, 32,589 individuals were identified as experiencing homelessness, up 8% from 2021.

- Eviction filings increased by 38% between 2021 and 2022, after a significant drop in filings in response to the COVID-19 pandemic.

- Homeowners’ median household income was just over $80,000, higher than the statewide median at $67,000, while renters’ median household income of $39,000 was significantly lower than both the statewide and homeowner average.

- In 2022, 51% of renters were housing-cost burdened, or spending more than 30% of income on housing. This includes 26% of renters who were severely housing-cost burdened, or spending more than half of income on housing.

- Among homeowners, 24% with mortgages and 14% without mortgages are housing cost-burdened.

61% of all housing units were built before 1980. The federal government banned lead-based paint in homes in 1978, meaning the majority of housing units across the state today are at high risk of exposing tenants to lead and its risks to health, especially for children. Nationally, the number of homes built before 1980 is at 49%.

More positive findings include:

- From 2012 to 2022, Michigan experienced a notable 50% surge in median home values, now standing at $224,400.

- From 2019 to 2021, 25- to 34-year-olds in Michigan saw higher gains in the number of people heading households, compared to their younger and older counterparts. This change likely reflects life stages or milestones common among this age, including increased cohabitation, marriage and child rearing.

- Rising household growth among 25- to 34-year-olds may have been influenced by federal stimulus checks and student loan repayment pauses during the pandemic which provided opportunities to live independently as renters and homeowners.

- In 2022, the median household income across renter- and owner-occupant households jumped from $40,683 annually for those under age 25 and to nearly $76,000 for those aged 25-44.

- From 2012-2022, building permits for new construction of multifamily dwellings increased 4.4 times and made up 26% of total permits allotted, a departure from the state’s historical pattern of predominantly single-family structure construction.

The research was funded in part by a $50,000 grant from U-M’s Office of the Vice President for Research under the Bold Challenges Initiative, which supports research that applies a health equity lens to housing issues such as unaffordability, inaccessibility and quality. Other support comes from the U-M Poverty Solutions and the MICHR PACE grant.

Student Research Assistants – Real world experience in evidence-based poverty research and solutions

Contact: Karissa Knapp, ktknapp@umich.edu

The mission at Poverty Solutions is to partner with communities and policymakers to find new ways to prevent and alleviate poverty through action-based research. A key player in this work is University of Michigan students. Poverty Solutions research assistants (RAs) are a crucial part of the team and the work Poverty Solutions does. They work side-by-side with Poverty Solutions researchers on important projects like the Guaranteed Income to Grow Ann Arbor (GIG A2) pilot, Prosecutor Transparency Project, Flint Rx Kids, Detroit Financial Well-being Innovation Project, Investing in Us, and the Washtenaw County Opportunity Index. This last year (2023-4), 62 RAs aided Poverty Solutions work.

“The students who worked on the Guaranteed Income to Grow Ann Arbor Pilot were instrumental to the successful launch and were really the public face of the project,” said Kristin Seefeldt, associate faculty director for educational programs at Poverty Solutions. “They helped people navigate the project’s application process, checked documentation, and onboarded participants once the project was up and running. A number are working with us on the research portion of the project. We’ve received extremely positive feedback from residents and program participants about them, reminding us just how important students are to our mission.”

Through working together, Poverty Solutions also hopes to give RAs quality research experience and guidance as they figure out where they may want to go next in their career and what kinds of research they may be interested in doing.

“Research assistantships at Poverty Solutions have been a launching pad for students from across the university to careers in policy, research, nonprofit, and government work,” said Trevor Bechtel, student engagement and strategic projects manager of Washtenaw County Programs at Poverty Solutions. “Students bring a variety of specialized skills from their coursework and previous life experiences and build those skills, learning new ones while they expand our capacity, and form the engine for some of the larger projects we’ve undertaken.”

Poverty Solutions research assistants come from many schools and colleges across the university, from engineering to social work, design to medicine, business to public policy, and undergrad through post doc. Having such a range of students with different insights and knowledge involved in Poverty Solutions’ work allows more unique ideation and problem solving to tackle the challenges being researched. Below are some conversations from the RAs about their experiences at Poverty Solutions, and where they may want to go next:

What skills did you learn/grow while at Poverty Solutions?

“I’ve worked on some research projects before this, but GIG A2 was my first experience with launching a research project. It is such a complicated process and I have so much respect for everyone on the team who was trying to plan for all of the unknowns!”

“I’ve worked on some research projects before this, but GIG A2 was my first experience with launching a research project. It is such a complicated process and I have so much respect for everyone on the team who was trying to plan for all of the unknowns!”

– Jaymie Tibbits, Social Work, 2nd year; GIG A2

“I have some experience in doing implementation on the analysis side, and this was an excellent opportunity to learn and take part in the process earlier in the research pipeline. Being able to take part and help with the logistics and public-facing aspects of enrollment into this kind of research study was really valuable for me.”

“I have some experience in doing implementation on the analysis side, and this was an excellent opportunity to learn and take part in the process earlier in the research pipeline. Being able to take part and help with the logistics and public-facing aspects of enrollment into this kind of research study was really valuable for me.”

– Francisco Brady, Public Policy, 1st year; GIG A2

“I also developed in learning how to exist in a role in a very large team. I understand more thoroughly the importance of clear and frequent communication with time-sensitive issues.”

“I also developed in learning how to exist in a role in a very large team. I understand more thoroughly the importance of clear and frequent communication with time-sensitive issues.”

– Andrew Wylie, Social Work, 1st year graduate student; Keep It Home

How did your work at Poverty Solutions develop or change your career interests?

“I’m interested in policy and legislation, and this experience has really reaffirmed my belief that it’s so important to talk to people about their lived experiences. Many folks I spoke with expressed that they just feel really stuck in their current financial situation. I think as policymakers, we need to be paying more attention to the fact that it is really debilitating to feel like you have no room for mobility in your life. I think that despondence bleeds into many other areas of the health and well-being of people and communities.”

“I’m interested in policy and legislation, and this experience has really reaffirmed my belief that it’s so important to talk to people about their lived experiences. Many folks I spoke with expressed that they just feel really stuck in their current financial situation. I think as policymakers, we need to be paying more attention to the fact that it is really debilitating to feel like you have no room for mobility in your life. I think that despondence bleeds into many other areas of the health and well-being of people and communities.”

– Jaymie Tibbits, Social Work, 2nd year; GIG A2

“[It] made me more interested in working with an organization like Poverty Solutions and/or becoming a researcher. I still have a strong interest in poverty alleviation and homelessness, so it is interesting to see how all the different Poverty Solutions projects target different facets of economic and personal well-being.”

“[It] made me more interested in working with an organization like Poverty Solutions and/or becoming a researcher. I still have a strong interest in poverty alleviation and homelessness, so it is interesting to see how all the different Poverty Solutions projects target different facets of economic and personal well-being.”

– Sadie Mrakuzic, Social Work, 1st year; GIG A2

“My experience with SummerWorks has motivated me to explore avenues for promoting equity and youth empowerment in my future roles. As an MBA candidate at the Ross School of Business, we often talk about social impact and discuss how we can be leaders in our future jobs. … I’ve come to appreciate that impact extends beyond monetary measures. It involves providing tangible skills and opportunities that can profoundly alter the trajectories of youth in the communities we serve. Whether advocating for our firms to participate as employers or stepping up as mentors, there are meaningful opportunities to make a difference in young adults’ lives and pave the way for their success.”

“My experience with SummerWorks has motivated me to explore avenues for promoting equity and youth empowerment in my future roles. As an MBA candidate at the Ross School of Business, we often talk about social impact and discuss how we can be leaders in our future jobs. … I’ve come to appreciate that impact extends beyond monetary measures. It involves providing tangible skills and opportunities that can profoundly alter the trajectories of youth in the communities we serve. Whether advocating for our firms to participate as employers or stepping up as mentors, there are meaningful opportunities to make a difference in young adults’ lives and pave the way for their success.”

– Dominique Downs, MBA candidate, Class of 2024; SummerWorks

What would you say to students interested in working with Poverty Solutions? Or any general advice to those interested in research in this space?

“Being an RA at Poverty Solutions is a great opportunity for professional growth. The researchers there are doing impactful work and you can be a meaningful part of it. I think it is a great way to get your foot in the door if you are interested in doing research in this space, since it is a well-known research hub. The Principal Investigator I worked for made sure that we were engaged at every part of the process and learned valuable skills. From data cleaning to interacting with participants, we had adequate training to feel empowered to handle each step. I would recommend it to anyone motivated to do research for social good.”

“Being an RA at Poverty Solutions is a great opportunity for professional growth. The researchers there are doing impactful work and you can be a meaningful part of it. I think it is a great way to get your foot in the door if you are interested in doing research in this space, since it is a well-known research hub. The Principal Investigator I worked for made sure that we were engaged at every part of the process and learned valuable skills. From data cleaning to interacting with participants, we had adequate training to feel empowered to handle each step. I would recommend it to anyone motivated to do research for social good.”

– Sadie Mrakuzic, Social Work, 1st year; GIG A2

“I would say that working at Poverty Solutions is a good option for students who are looking to gain exposure to interdisciplinary research and access to researchers who are passionate about honoring and centering the communities they research. My general advice to everyone starting a research position is don’t be afraid to ask questions, nobody will bite!”

“I would say that working at Poverty Solutions is a good option for students who are looking to gain exposure to interdisciplinary research and access to researchers who are passionate about honoring and centering the communities they research. My general advice to everyone starting a research position is don’t be afraid to ask questions, nobody will bite!”

– Francisco Brady, Public Policy, 1st year; GIG A2

“I would advise anyone interested in working in this research space to come with an open heart and a curious mind. The research team I worked with was incredibly thoughtful and took a lot of care setting up the study in a way that centered the participants’ unique experiences. There was a very clear distinction from the start that the participants we would be working with are PEOPLE first. Poverty Solutions really embodies how I think all researchers should approach their work, with an inclusive focus on the lives of those they are trying to learn from. Lastly, I was so proud to work on a project that was designed to intentionally disrupt some of the bureaucratic systems that act as barriers to autonomy for many people living in poverty. This experience helped me to envision a system of social services rooted in justice and respect, to use as a blueprint for the future.”

“I would advise anyone interested in working in this research space to come with an open heart and a curious mind. The research team I worked with was incredibly thoughtful and took a lot of care setting up the study in a way that centered the participants’ unique experiences. There was a very clear distinction from the start that the participants we would be working with are PEOPLE first. Poverty Solutions really embodies how I think all researchers should approach their work, with an inclusive focus on the lives of those they are trying to learn from. Lastly, I was so proud to work on a project that was designed to intentionally disrupt some of the bureaucratic systems that act as barriers to autonomy for many people living in poverty. This experience helped me to envision a system of social services rooted in justice and respect, to use as a blueprint for the future.”

– Jaymie Tibbits, Social Work, 2nd year; GIG A2

If you’d like to learn more about student opportunities at Poverty Solutions, please visit our student page for more information on the Poverty Solutions certificate and research opportunities, or email Trevor Bechtel at betrevor@umich.edu.

Interested in more? Sign up for the Poverty Solutions Student Newsletter – be sure to indicate “Student Involvement.”

New Michigan poverty map identifies needs related to education, food insecurity, affordable housing

Contact:

Karissa Knapp, ktknapp@umich.edu

Jared Wadley, jwadley@umich.edu

ANN ARBOR—A new data map showcasing diverse indicators of poverty and well-being throughout Michigan highlights the key challenges confronting residents in different parts of the state and suggests interventions for the state’s most critical needs.

Poverty Solutions at the University of Michigan has released an updated version of its Michigan Poverty & Well-being Map with statewide, regional and county data. The new iteration of the map, which Poverty Solutions has maintained since 2017, features 2021 data from the Census Bureau’s American Community Survey.

Luke Shaefer, Director of Poverty Solutions at U-M

The revised map separates the data by Michigan’s 10 Prosperity Regions, which allows viewers to look at the unique dynamics at play in different areas of the state.

“The poverty rate alone doesn’t give us a complete story of how many people are facing economic instability and hardship. The Michigan Poverty & Well-being Map looks at multiple metrics to give us a more holistic idea of how Michiganders are doing,” said Poverty Solutions faculty director Luke Shaefer, professor of social work and public policy.

Some key metrics from the data include:

- 13% of Michiganders were living on income below the federal poverty line, which is about the same as the previous year. The national poverty rate is 11.5%.

- 17.6% of children under age 18 were in households below the federal poverty line.

- 31.3% of residents paid 30% or more of their income on housing costs, which is above the threshold of what’s considered affordable.

Amanda Nothaft, Director of Data and Evaluation at Poverty Solutions

“The disparities highlighted by the map can inform how state and local officials address these issues and where to invest resources to support their residents, their region and the state,” said Amanda Nothaft, director of data and evaluation at Poverty Solutions, who led the data analyses for the map project.

Investing in education, for example, by expanding preschool programs and providing additional training beyond high school, is one recommendation Nothaft makes. This kind of funding for education could improve employment prospects and economic well-being in the state, she says. Other areas of need illustrated by the data include food insecurity, affordable housing, child poverty, child care, unemployment and income.

Learn more about each region’s challenges by viewing the regional fact sheets:

- Detroit Metro: High Housing Costs Burden Residents

- East Michigan: Investment in Education Can Boost Wages

- East Central Michigan Sees High Rates of Food Insecurity, Despite High Rates of Food Assistance

- Northeast Michigan Faces Highest Child Poverty Rates in the State

- Northwest Michigan: Tight Housing Market Puts Cost Burden on Renters

- South Central Michigan: Investing in Education in Lansing Can Boost Economic Well-being

- Southeast Michigan: Racial Disparities Underlie Strong Economic Position of Residents

- Southwest Michigan: Many Residents Are Above the Poverty Line But Still Struggling

- Upper Peninsula Residents Face Cost of Living Challenges

- West Michigan Should Invest in Addressing Poverty in Lake County

How do we measure poverty?

Nothaft explains measurements used at Poverty Solutions and in the Michigan Poverty & Well-being Map.

Payments begin for 100 low-income entrepreneurs in Guaranteed Income to Grow Ann Arbor pilot

Poverty Solutions Associate Faculty Director Kristin Seefeldt (left) and Graduate Student Research Assistant Emily Shupp Parker (center) share information on Guaranteed Income to Grow Ann Arbor at the Green Fair in downtown Ann Arbor on Sept. 22, 2023. (Lauren Slagter | Poverty Solutions)

Contact: Lauren Slagter, lslag@umich.edu

ANN ARBOR – One hundred Ann Arbor entrepreneurs, gig workers, and other independent workers with low incomes have received their first two guaranteed income payments of $528 as part of the Guaranteed Income to Grow Ann Arbor (GIG A2) pilot program. Payments started in January and will continue monthly through the end of 2025.

Poverty Solutions at the University of Michigan will evaluate the pilot program to determine whether the monthly payments:

- Positively contribute to participants’ social determinants of health, specifically through increased housing, food, and transportation security, improvements in physical and mental health and access to care, and improvements in access and quality of child care;

- Help small businesses and entrepreneurs stabilize and/or grow their businesses; and

- Allow entrepreneurs the time and resources to focus on their business.

Another 100 Ann Arbor entrepreneurs with low incomes who will not receive the monthly payments have been enrolled into the research group to support the research findings from this pilot.

“I’d like to give a special thanks to those participating in the research group, as they play a valuable role for us to compare outcomes between the two groups and draw more robust conclusions about the potential impact of receiving a guaranteed income payment as an entrepreneur,” said Kristin Seefeldt, the principal investigator for the research study, an associate professor of social work and public policy, and associate faculty director of U-M’s Poverty Solutions.

“The research findings will inform policymakers on the effectiveness of cash assistance programs and better ways to provide assistance for people who may need it,” Seefeldt added.

Funds for this pilot program come from the federal American Rescue Plan Act (ARPA) through the City of Ann Arbor and the Ann Arbor Area Community Foundation (AAACF).

“We are delighted this important program is up and running, and grateful for our partnership with the University of Michigan to make it happen,” said Mayor Christopher Taylor. “Guaranteed income is an idea whose time has come. I’m proud that Ann Arbor is able to support these individuals and their families and also work with researchers to answer important questions about the efficacy and impact of these programs.”

“We are inspired by the opportunity to join forces on this vital initiative, supporting entrepreneurs and small business owners in need,” said Shannon Polk, president and CEO of the Ann Arbor Area Community Foundation. “By leveraging the University of Michigan’s research data to provide guaranteed income, we are not only supporting families but also embracing the transformative impact of collaborative community partnerships.”

Additional support for this pilot program comes from Steady, the payment distributor; research assistants from U-M’s School of Social Work, Ford School of Public Policy, and School of Public Health; and many community organizations in Ann Arbor and at the state level.

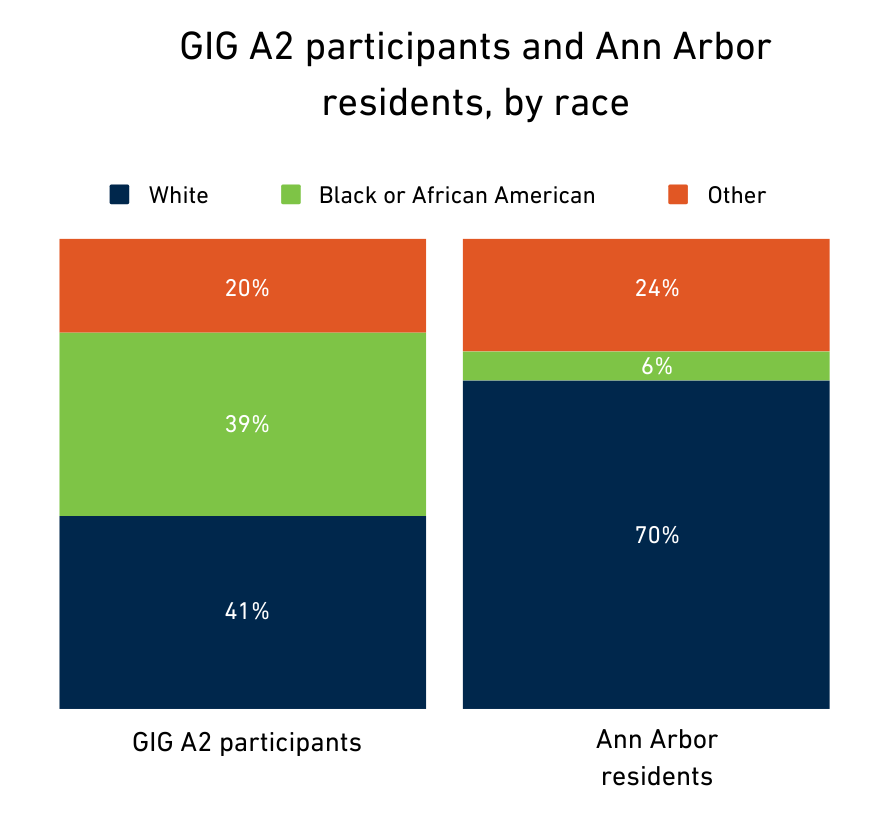

The chart shows the racial demographics of GIG A2 participants and Ann Arbor residents. Graphic by Dana Schau

The 200 GIG A2 participants are entrepreneurs, small business owners, and gig workers with low incomes who live in Ann Arbor. For this pilot, low income means within 225% of the federal poverty line, or $44,370 for a two-person household. GIG A2 participants were randomly selected to reflect the demographics of the eligible application pool of about 500 people. A demographic breakdown of eligible GIG A2 applicants is below:

- Race/Ethnicity: 41% of participants are White, 39% are Black, and 20% specified another race or ethnicity.

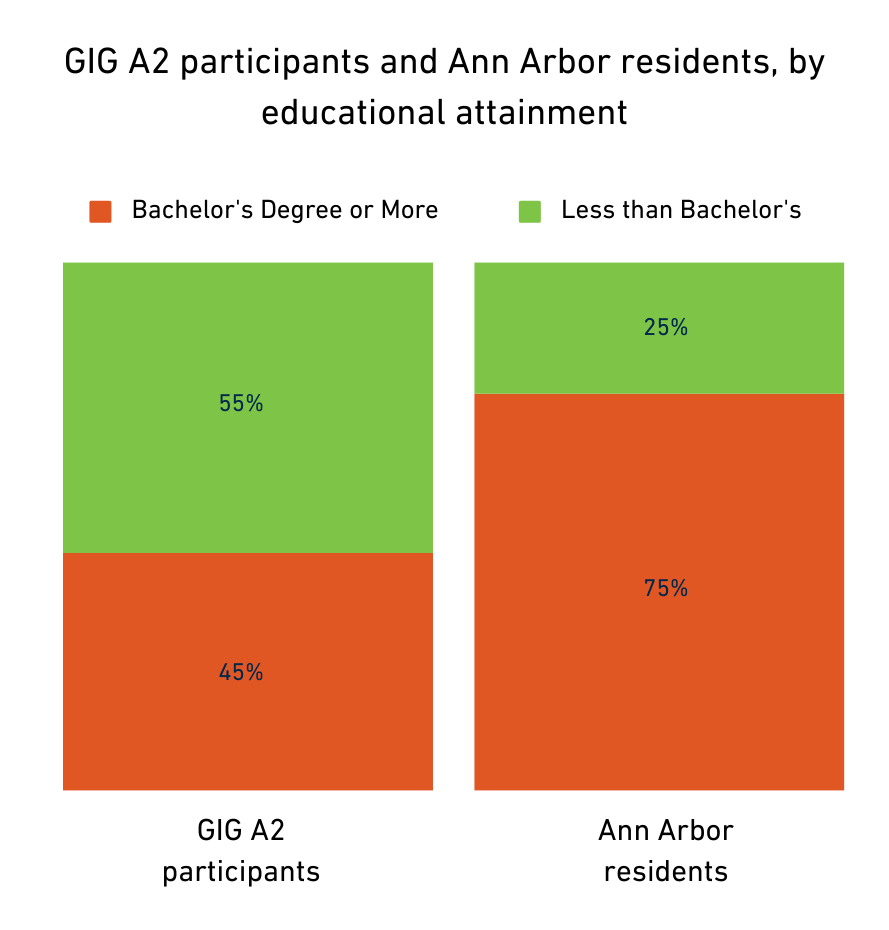

- Education: 55% of participants do not hold a bachelor’s degree, 45% hold a bachelor’s degree or higher.

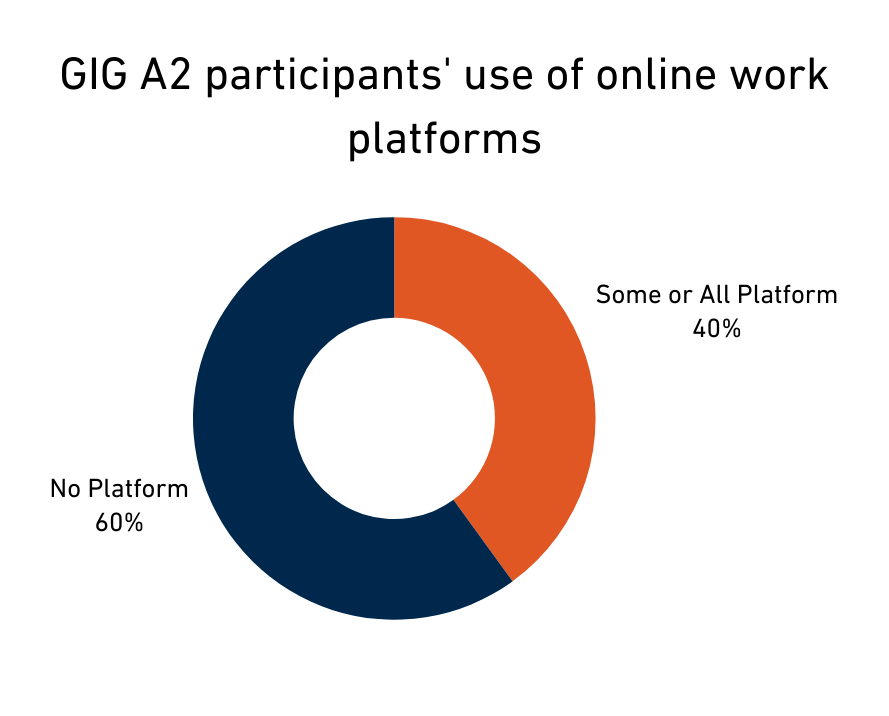

- Type of Work: 60% of participants do not use a platform or app for their entrepreneurial work, 40% of participants use a platform or app like Uber, DoorDash, TaskRabbit, Fiverr, or YouTube. GIG A2 participants work in the following sectors: food and events, arts and entertainment, personal and health care services, maintenance work, and a variety of other kinds of work.

Over the next two years, GIG A2 participants will partake in surveys and interviews as part of the research study. GIG A2 participants who are not receiving the guaranteed income payments will be paid a small stipend, starting in March from funds contributed by AAACF, for participating in the research study until the end of 2025.

Over the next two years, GIG A2 participants will partake in surveys and interviews as part of the research study. GIG A2 participants who are not receiving the guaranteed income payments will be paid a small stipend, starting in March from funds contributed by AAACF, for participating in the research study until the end of 2025.

To receive a quarterly email newsletter with updates on GIG A2, please sign up here.

Press release written by Emily Shupp Parker

Detroit residents’ trust in police shaped by history of police contact

Contact: Lauren Slagter, lslag@umich.edu

DETROIT – Detroit residents who have had any type of contact with police are more critical of police than people who have no contact with police, according to a survey of Detroit residents from the University of Michigan.

U-M’s Detroit Metro Area Communities Study surveyed residents about their personal experiences with police in July 2020, shortly after George Floyd’s death at the hands of Minneapolis police officer Derek Chauvin. DMACS surveyed a representative sample of Detroit residents, and results have been weighted to reflect the population of the city of Detroit.

The survey asked about three types of interactions with police: forceful contact, nonforceful contact and no contact in the last year. Detroiters commented on their personal experiences as well as the experiences of their family and acquaintances, referred to as proximate contact. A new report analyzing the survey data found 37% of residents had personal or proximate contact with police.

Two percent of Detroit residents reported personal experiences with forceful police contact in the last year. Given Detroit’s total adult population estimate in 2020, this translates to about 8,755 adult residents experiencing forceful contact for the year. When including proximate contact, 17% of Detroiters either personally experienced or knew someone who experienced forceful police contact.

There are no significant racial differences among residents who experience personal or proximate forceful contact from the police, and there are no differences in experience of forceful police contact among Detroiters of different income levels, education levels and age cohorts. Women are less likely than men to report exposure to forceful police contact.

While any type of police contact correlated with more critical views of police, Detroiters who have had forceful contact with police tend to be even more critical of police than those with nonforceful contact.

Fifty-six percent of those who experienced forceful contact with police disagree that police are doing a good job protecting them and their neighborhood versus 33% of those with nonforceful contact and 22% of those with no police contact. Fifty percent of those with forceful contact disagree that police can be trusted in comparison to 27% of those with nonforceful contact and 19% of those with no contact.

“The similarities in views between residents who have experienced forceful and nonforceful contact with police suggests any type of contact with police may be enough to change people’s views on policing,” said Lauren Chojnacki, a research associate with DMACS who authored the report.

The survey analysis also found age is an important factor in determining Detroiters’ views toward police, especially among those who have experienced forceful contact. Detroiters aged 18-30 tend to hold more negative views toward the police than older Detroiters. Young Detroiters who experienced forceful police contact are more than twice as likely to disagree that the police are doing a good job in comparison to young Detroiters with no police contact (80% compared to 36%).

These survey findings add to a previous analysis of a DMACS survey on residents’ views on crime and policing conducted in summer 2021. That survey found 42% of residents said greater police presence in their neighborhood would make them feel safer, while 10% said more police in their neighborhood would make them feel less safe.

“There’s a simultaneous desire for police reform and favorable public opinion regarding police,” Chojnacki said “There’s a tension among residents who want both change in a system and the security and protection experienced within that system.”

Washtenaw County Prosecutor’s Office, ACLU of Michigan, University of Michigan announce release of Prosecutor Transparency Project study

Robust, Data-Driven Project Examines Racial Inequities in Prosecutorial System

Contacts: Liz Mack (Washtenaw Prosecutor’s Office), macke@washtenaw.org, 734-585-6714

Ann Mullen (ACLU of Michigan), amullen@aclumich.org, 313-400-8562

J.J. Prescott (U-M Law), jprescott@umich.edu, 734-763-2326

Trevor Bechtel (Poverty Solutions), betrevor@umich.edu, 734-615-0216

ANN ARBOR – Today, the Prosecutor Transparency Project released findings from a multi-year analysis of racial disparities in the prosecutorial system in Washtenaw County. The Prosecutor Transparency Project — a collaboration between the Washtenaw County Prosecutor’s Office, the ACLU of Michigan, the University of Michigan Law School, and the University of Michigan’s Poverty Solutions — seeks to analyze potential racial disparities in decisions made by the Washtenaw County Prosecutor’s Office.

A detailed summary of the findings is available at https://myumi.ch/23NQ4

As part of the Prosecutor Transparency Project, the Prosecutor’s Office gave independent researchers at the University of Michigan Law School complete access to its criminal case management systems, containing data from nearly 35,000 cases from 2017-2022. Those researchers analyzed the data to determine whether racial disparities exist at key prosecutorial decision-making points.

The Prosecutor Transparency Project represents the first time independent researchers have been provided access to extensive prosecutorial data in Michigan for the purpose of conducting a race-equity analysis. The Washtenaw County Prosecutor’s Office provided researchers from the University of Michigan unfettered access to felony and misdemeanor files, making the project one of the most comprehensive empirical studies on prosecutorial decision-making in the nation. The study also traverses two prosecutorial administrations, as Prosecuting Attorney Eli Savit took office in 2021.

The research team was led by Professor J.J. Prescott and Grady Bridges of the University of Michigan Law School. Prescott is one of the nation’s top empirical criminal justice scholars. Bridges has years of experience collecting and analyzing Michigan criminal justice data and served as data administrator for Michigan’s Criminal Justice Policy Commission.

Previous analyses—including the 2020 Citizens for Racial Equity in Washtenaw (CREW) report—have indicated that Black residents in Washtenaw County are disproportionately likely to face criminal charges. Although the Transparency Project focused specifically on prosecutorial decision-making (and did not purport to reach any conclusions about other systems actors), the University of Michigan’s analysis found that these numeric disparities are largely “baked in” by the time cases arrive at the Prosecutor’s Office.

Controlling for factors such as the severity of a case, the researchers also identified small disparities in certain prosecutorial decisions and no evidence of disparities in others.

Specifically, the study concluded:

- The prosecutor’s office was 0.7 percentage points more likely to authorize charges for defendants of color than for white defendants between 2017 and 2022. Though that disparity is marginally statistically significant, its statistical significance is driven by data from one year (2019).

- Defendants of color were charged with crimes having maximum sentences 2.15 months longer than white defendants in similar circumstances, with statistically significant disparities that were larger in 2018 and 2020.

- Among eligible defendants, people of color are less likely than white people to be designated as habitual offenders. A habitual offender designation means longer maximum sentences.

- Defendants of color faced 0.05 more charges per case on average than white defendants in similar circumstances between 2017 and 2022.

The study also looked for evidence of racial disparities in whether defendants are admitted into diversion programs — which allow a defendant to avoid a criminal record upon completion of a plan. The study found no evidence of racial disparities into whether similarly situated defendants are admitted into two programs: the Prosecutor’s pre-plea diversion program and the Holmes Youthful Trainee Act.

Finally, the study sought to identify potential racial disparities in plea bargaining decisions. Data limitations precluded the research team from reaching robust conclusions about plea-bargaining practices. However, its preliminary plea bargaining analysis did not find evidence of racial disparities.

“The Prosecutor and his team were always vigilant about protecting people’s privacy, but the office also made sure we had access to every bit of information we asked about that might be relevant to measuring disparities,” said J.J. Prescott, the Henry King Ransom Professor at the University of Michigan Law School. “Throughout the entire process, the Prosecutor has been eager for unvarnished answers so the office can continue to improve. PTP’s assessment in Washtenaw County provides a clear roadmap for conducting similar audits throughout Michigan and the nation.”

“The comprehensive nature of this study also puts Washtenaw County and Michigan more generally on the map in terms of evidence-based evaluation of prosecutorial decision making,” Prescott added. “Our analysis improves on other studies that have explored racial disparities in prosecutorial decision-making. Most existing work focuses on specific types or classes of cases, or suffers from significant data limitations that make it hard to pinpoint the sources of disparities. Our evaluation is not without weaknesses, of course, but we use the ‘blind spots’ in data collection and management that we uncover to shine a bright light on the need for critical data infrastructure improvements. For this reason, this collaborative effort takes an important step toward the goal of measuring, understanding, and working to eliminate disparities in prosecutorial decision-making.”

“Consequences in the criminal legal system should be imposed because of what someone did, not because of who they are,” said Washtenaw County Prosecuting Attorney Eli Savit. “I’m grateful to the research team for taking an unflinching look at potential racial disparities in prosecution. I am also grateful to the ACLU for funding this project, allowing this work to be completed without taxpayer expenditure. The data from this report will inform our continuing efforts to promote equal justice in our system.”

“The researchers’ independent report, for me, confirms my observations that our assistant prosecutors charging and resolving cases are doing so in a manner consistent with fairness and justice, not based on the color of someone’s skin,” said Washtenaw County Chief Assistant Prosecutor Victoria Burton-Harris. “As a leader of this office, that’s important to me. I’m proud to stand by it, and I look forward to continued efforts to ensure transparency and equity in our system.”

“A critical step in beginning to address the racial disparities in the criminal legal system is for agencies to track, analyze, and make publicly available data at every stage of the criminal legal process,” said Loren Khogali, executive director of the Michigan ACLU. “We commend the Washtenaw County Prosecutor’s Office for taking a look in the proverbial mirror and contributing to a growing body of data-driven studies, which also show how our criminal legal system has an inequitable impact on people of color, especially Black people. This report adds to the imperative that agency leaders throughout Michigan, including police chiefs, prosecutors, judges, and court administrators, also hold themselves accountable by examining their part in our deeply flawed criminal legal system.”

The Prosecutor Transparency Project’s full 116-page report is available for the public to read at

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4680695. In addition, to promote data accessibility, Poverty Solutions at the University of Michigan has published a digestible, interactive digital report outlining the key takeaways from the analysis, which is available at https://myumi.ch/23NQ4.

Dr. Trevor Bechtel — who has led multiple projects designed to increase access to information — spearheaded that effort.

“Working on the Prosecutor Transparency Project has allowed us at Poverty Solutions to bring our commitment to data and accessibility and transparency to work understanding the criminal legal system,” said Bechtel, the strategic projects manager of Poverty Solutions’ Washtenaw County programs. “We are excited to continue working with the Prosecutor Savit’s office as we move towards release of a data dashboard on prosecution in our county.”

Next steps for the Prosecutor Transparency Project include the identification of trackable metrics to ensure equitable treatment in the justice system and the creation of an interactive “data dashboard” for the Prosecutor’s Office. Results will continue to be made available as they are completed.